Discussing insurance is about as interesting as watching paint dry. And while the ‘excitement factor’ is nonexistent with this topic, understanding and purchasing additional coverage is super important when shipping your valuable goods, especially if it switches hands multiple times (or even in possession by one party, for that matter).

Before we get ahead of ourselves, what is cargo insurance?

Cargo insurance is additional coverage that protects you from financial loss from your goods either being lost, damaged, or stolen during transit. It pays you the amount you’re insured for if a covered event happens to your freight.

What are the various types of coverage for cargo?

Did you notice we said “coverage” and not “insurance?” That’s because there are distinct differences between the two. Let’s dive into what sets each of these apart.

Limited Liability Coverage

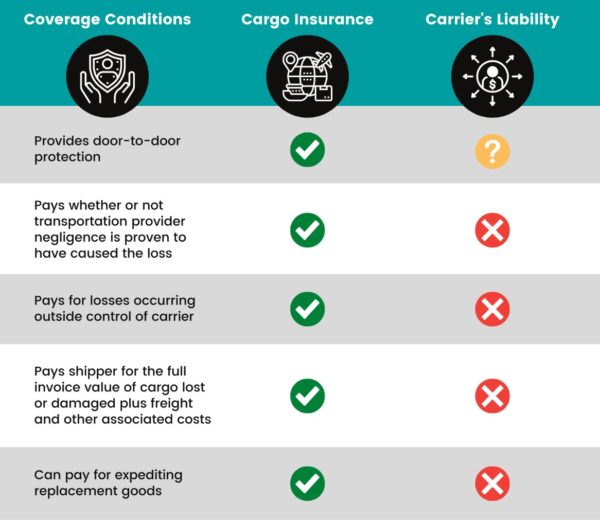

Legally, all carriers must carry a minimum amount of insurance. This is referred to as carrier liability (or limited liability on the customer side). This type of coverage is offered by freight carriers but is not the same as being insured for the value of the goods being shipped.

Under Limited Liability, Shippers are not covered for damage or loss due to common external factors, such as Acts of God, Acts of War, strikes, riots, theft, spoilage, or anything else out of the carrier’s immediate control. In addition, if you cannot prove carrier negligence, you will not be entitled to any payout for lost or damaged goods, which is why more than half of all Limited Liability claims are denied entirely.

Declared Value Coverage

This type of coverage is a form of cargo damage/loss coverage that raises the carrier’s financial liability, so it matches the cargo’s declared value. Declared value is not cargo insurance.

Declared value coverage is limited to the period of time when the cargo is in possession of a single carrier, and it only applies if the damage or loss occurred due to the carrier’s negligence. It is the responsibility of the shipper to prove the carrier was negligent.

This type of coverage is often subject to deductibles, exclusions, warranties, and policy limits that aren’t made clear to the shipper.

All-Risk Insurance Coverage

“All Risk” insurance is the broadest, most comprehensive form of cargo coverage. This type of coverage insures cargo against risks of physical loss or damage from any external cause, subject to policy terms, conditions, and exclusions. The cargo is insured based on its value without respect to weight or piece count and can be applied for door-to-door coverage on any mode, including ocean, air, and land.

When considering insurance, keep in mind the cost of lost or damaged cargo without All-Risk insurance is likely to be much higher than the cost of the protection from the start.

What are the benefits of purchasing additional insurance?

Really, there is one big overarching benefit to purchasing additional insurance— minimizing your financial loss. In addition, purchasing cargo insurance can reduce the frequency of cargo legal liability claims and help protect your assets.

Cargo insurance is first-party coverage, which means in the event of a covered loss, the insurance company will pay out the claim to the shipper and then, if necessary, subrogate against the carrier.

By purchasing cargo insurance through ICAT Logistics, Inc., shippers secure the most comprehensive coverage for their goods. Coverage through ICAT Logistics is backed by the largest and most respected insurance broker in the industry.

What are your next steps?

Talk to your ICAT Logistics account representative or operations expert today to learn more about insuring and protecting your valuable assets to ensure you will be properly compensated for any unavoidable losses!

Without cargo insurance in place, you may only be compensated for a small portion of what your cargo is worth—or not at all—in the event of a loss. Cargo insurance provides an additional layer of protection for the full commercial invoice value plus freight.

What happens if I didn’t purchase additional insurance and need to file a claim?

Losses, damages, and theft unfortunately occur. We understand that it is not an ideal situation, and the claims process can be overwhelming and less-than-pleasant.

If you are currently facing a claim situation or want to have some guidance on the claims process, read our blog Navigating the Claims Process: What You Need to Know. As always, if you have any questions or concerns regrading cargo insurance or claims, please reach out to us at .

Resources:

- What is Cargo Insurance: Benefits, Types & Coverage (FreightPros)

- Inside the Intangible Benefits of Cargo Insurance (Roanoke Trade)